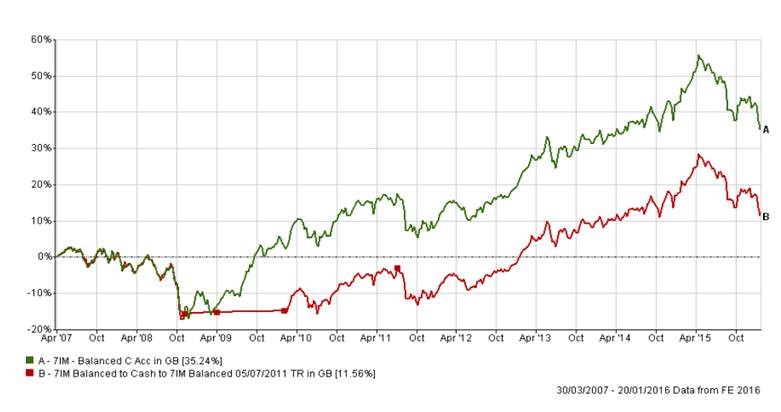

Many of our clients are investing for the long term and therefore short term falls are acceptable. However it can be difficult for clients who have just invested for the first time when there is a sudden decline in prices. Sometimes we get a call to instruct us to sell the investments and re-invest when confidence has returned and markets have risen. As you can see from the graph, this approach can make a serious dent in your long term returns and can be a bad decision.

When you come out of the market it is very difficult to know when you should actually get back in. The statistics show quite clearly that if you miss out on some of the key days of gains over a period you will substantially limit your returns. As the S&P showed us between 1st January 1995 and 31st December 2014, some 5,036 days, if you had missed out just the best 5 days during that time you would have lost out on just under 40% of your gain had you stayed invested. Thus it is after such days of falls we are likely to see such positive days of bounce back, so if you are not in it you are not going to get it! (Source: www.ifa.com)

When reading this a member of the Client Services team, James compared this to, “if you go to the Welsh coast and you want 5 days of good weather, you need to be over there for the whole summer”. I think he might have a valid point!